It’s true that Bitcoin halving is one of the most trending topics in the cryptocurrency space right now. However, let’s not forget the impact this has on Bitcoin mining. Over the years, Bitcoin mining has evolved into a substantial industry, being influenced by many other factors like market prices, network security, and mining operations.

There’s a lot in common with Bitcoin mining and halving. Primarily, Both mining and halving events have a direct impact on the miners. Notably, during a halving event, miners record a reduction in the rewards they receive. Of course, this can impact the profitability of mining firms, which will lead to either some miners exiting the network or upgrading their equipment to maintain competition.

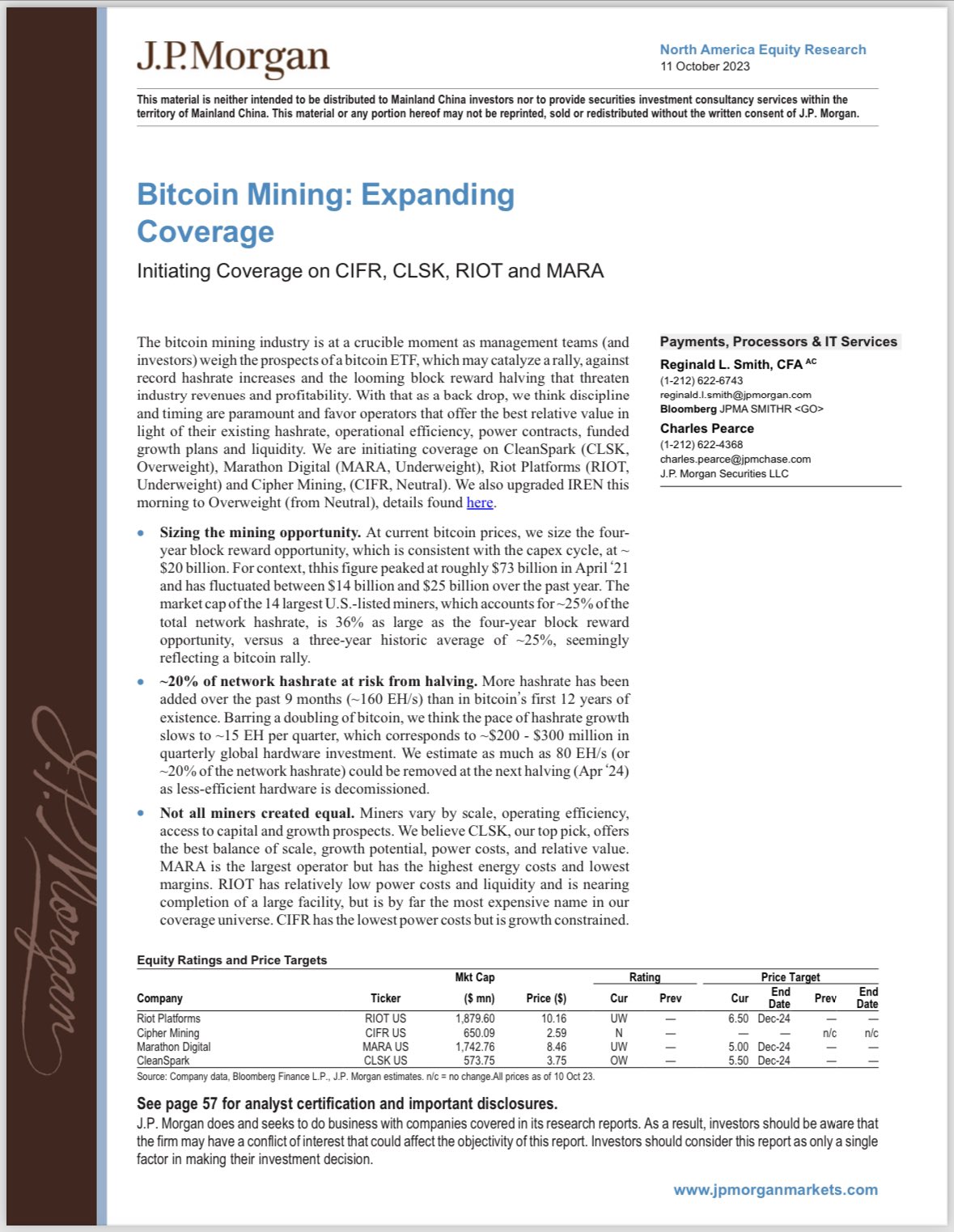

However, JPMorgan has released some insights on the next Bitcoin halving, which drives attention. JPMorgan Chase & Co (or JPMorgan) is one of the largest and most prominent financial institutions in the world.

Three Points To Pick Out From The Report

Crucible Moment For Bitcoin Mining

The report begins by affirming that “The Bitcoin mining industry is at a “crucible moment”. Of course, this is because at current Bitcoin prices, the four-year block reward opportunity stands at around $20 billion.

Normally, this situation should represent a lucrative opportunity. However, it’s essential to recall that this figure once peaked at around $71 billion in April 2021. Notably, It keeps fluctuating between $14 billion and $25 billion over the past year.

20% Hashrate Drop Post Bitcoin Halving

The report further highlights that due to the increasing hashrate in the last 9 months, there’s a concern that around 20% of the network hashrate might be at risk during the next halving. The next halving event is expected to occur in April 2024.

“We estimate as much as 80 EH/s (or 20% of the network hashrate) could be removed at the next halving (April ‘24) as less-efficient hardware is decommissioned”

Mining Efficiency Rating

According to the report, CleanSpark comes out as a top pick for its balance of scale, growth potential, power cost, and relative value.

Furthermore, MARA sets out as the largest operator but faces higher energy costs and lower margins.

It’s important to recall that the Bitcoin halving, which happens every 4 years, involves a reduction in Bitcoin miners’ rewards by half. Already, its primary goal is to help mitigate inflation. This deflationary mechanism is embedded into Bitcoin’s code.

Join Us On Telegram and Coinmarketcap