Bitcoin Poses Historic 180 Days Chart Pattern To Previous Halving Events, Will History Repeat?

Patterns are a significant approach in reading charts in any trading field, particularly in the Bitcoin market. Most analysts have traded multiple cryptocurrencies being guided by what they can interpret on their charts. Then, most of the time, these charts are full of patterns and historic movements.

This is not different when it comes with Bitcoin. Although, many believe that Bitcoin trades off with fundamentals rather than technical analysis. Of course, this is due to how Bitcoin has responded to events in the past. We have seen Bitcoin spike up in price due to a massive adoption news. Particularly, Bitcoin has always been volatile whenever ETFs news is released. However, Bitcoin’s newest posture suggests it’s about following the same patterns leading up to previous halving circles.

Bitcoin’s Historic 180 Days Pattern, Leading Up To The Halving Events

Bitcoin halving is an important event in the cryptocurrency space and how analysts view it is also as important as the event. The Bitcoin halving refers to the reduction of the rewards due to miners for verifying transactions and adding them to the Bitcoin network. It is programmed to happen approximately every four years automatically.

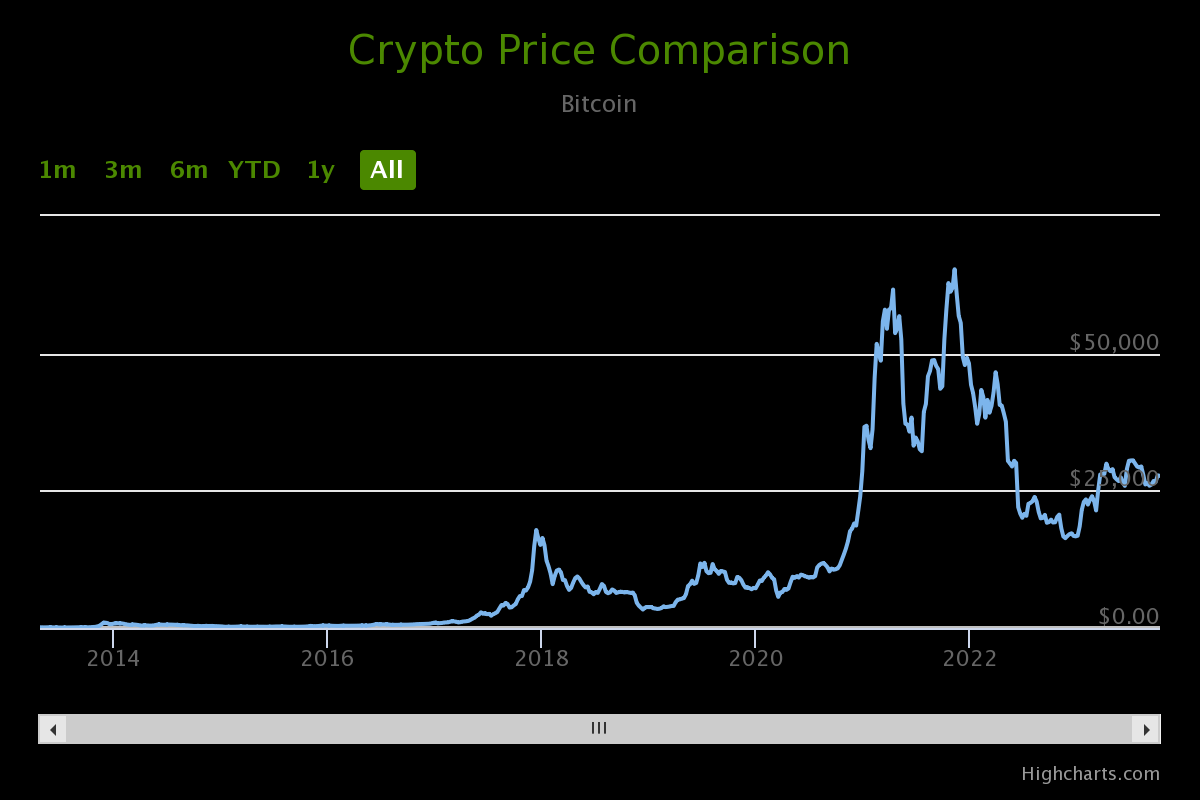

Historically, in the year 2016, Bitcoin $BTC was trading at -65% below its all-time high (ATH). The halving happened the same year, on July 9, 2016. Block reward was reduced from 25 BTC to 12.5 BTC.

Also, in the year 2019, Bitcoin’s BTC price was at -60% below its all-time high, before the halving event in 2020. The halving occurred on May 11, 2020, when the Block reward was reduced from 12.5 BTC to 6.25 BTC.

Presently, in 2023, Bitcoin’s price is mirroring the same pattern as seen in previous years as it’s currently situated at -61% below its ATH of $69k in 2021. The next Bitcoin Halving event is anticipated to occur around May 2024, with a block reward reduction from 6.25 BTC to 3.125 BTC.

Bitcoin Despite Struggling Within $28K Levels, Still Maintains Significant Milestone This Year

Of course, Bitcoin, no doubt has had the most remarkable year, maintaining a return of 67%, which surpasses the performance of most other assets in the market. Bitcoin, despite falling about 60% from its ATH, has, since this year, maintained a significant strength and posture. Even among stocks and other asset classes, Bitcoin has always maintained the top spot.

This makes digital gold become more attractive to both retail and institutional interest. We are already witnessing massive ETFs applications from top asset managers in the world like the Asset Manager, Fidelity.

$4.5Trillion Assets Manager Evaluates Bitcoin’s Unique Qualities

Recently, Fidelity, a popular asset manager with $4.5 trillion under management, affirmed that BTC retains its position as the most secure and decentralized crypto. This is especially when compared to other asset classes.

JUST IN: $4.5 trillion asset manager Fidelity says #Bitcoin is the most secure, decentralized, sound digital money compared to any other digital asset.

— Watcher.Guru (@WatcherGuru) October 9, 2023

The asset manager went on to highlight some notable qualities that place Bitcoin in this position, calling Bitcoin the most “secure, decentralized and sound digital money (relative to other digital assets).” The statement further detailed that “Bitcoin is best understood as a monetary good and one of the primary investment theses for bitcoin is as the store of value asset in an increasingly digital world.”