Nexus Mutual Review: Insurance Coverage for Smart Contracts – Unveiling the Pros, Cons, and Everything In-Between

Introduction

Hey there, crypto supporters and safety-seekers! If you’re involved in the world of smart contracts, you might be wondering how to shield yourself from potential risks. That’s where Nexus Mutual comes into the picture. In today’s detailed review, we’ll break down everything you need to know its smart contract insurance. So, let’s get down to brass tacks!

What Is Nexus Mutual?

In a casing, Nexus is a decentralized insurance platform that specializes in offering coverage for smart contracts. Launched in 2017, it aims to provide a safety net for those experimenting in decentralized finance (DeFi) or participating in blockchain-based projects.

How Does It Work?

Nexus Mutual operates on a peer-to-peer model. Unlike traditional insurance companies that rely on centralized systems, uses blockchain to democratize coverage. Users can buy using the platform’s native token, NXM, and claims are assessed by the community itself.

The Good Stuff:

Benefits of Nexus Mutual – Community-Driven

Transparency:

The decentralized nature ensures transparency and fairness.

Fast Claims:

Community voting speeds up the claim approval process.

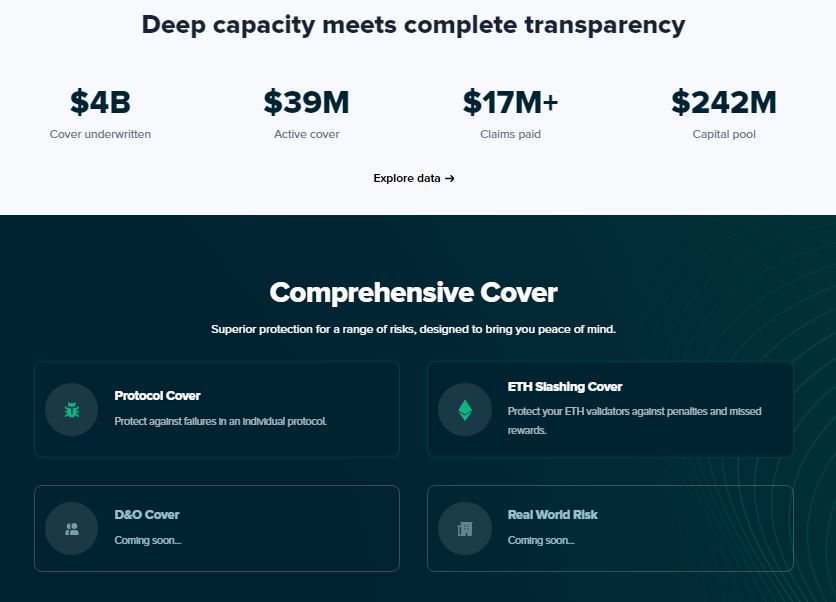

Flexible Broad Scope Coverage:

Beyond smart contracts, Nexus Mutual offers centralized exchanges and wallet protection.

Personalized Policies:

Choose your level of coverage based on your needs and budget.

The Caveats:

Risks and Limitations

Fluctuating Cost Factor Token Prices:

The cost of coverage can vary depending on the value of NXM tokens, which may not suit everyone.

Curve Learning Complexity:

It’s not as straightforward as traditional insurance, requiring a basic understanding of blockchain and DeFi.

Pricing and Plans: What’s It Going to Cost You?

While pricing varies based on the type of coverage and duration, the cost generally ranges from 2.6% to 3.2% of the amount per year. Make sure you compare various options before making a decision.

User Experience: Navigating the Platform

The platform is user-friendly, offering a clean interface and detailed FAQ sections. However, newcomers to blockchain technology may find the initial setup a bit challenging.

Frequently Asked Questions (FAQs)

Is Nexus Mutual Safe?

Generally speaking, Considered safe due to its decentralized, transparent model. However, like all investments, it’s not risk-free.

How Do I Buy Coverage?

Can be bought using the Nexus platform, payable in NXM tokens.

Can I Trust Community-Based Claim Approval?

While the community-based approach offers transparency, it’s essential to remember that no system is entirely foolproof.

Conclusion

Nexus Mutual brings an innovative, community-driven approach to the traditional world of insurance, specifically targeting the volatile landscape of smart contracts and DeFi. While it offers multiple benefits like transparency and a broad scope of coverage, potential users should also consider the pricing volatility and complexity of the platform.

So, the insurance haven for your smart contracts? Only you can make that call, but we hope this review sets you on the path to making an informed decision.

Stay safe and keep learning – keep exploring blockchain! Join Our Telegram Channel