Introduction

Welcome to the world of best yield farming platforms in 2023, We will discuss in detail Aave, Years & Curve a high-reward game that could boost your crypto returns. So you’ve decided to take into the world of crypto. Praise! But what if we told you there’s a way to make your cryptocurrency grow while you’re busy binge-watching your favorite shows?

What is Yield Farming?

Before we dive in, let’s break down the best yield farming platform production for the uninitiated. It’s basically putting your crypto assets to work by lending them out or putting them in a liquidity pool. It’s like an advanced savings account, but instead of small interest rates, you could potentially score much higher gains. Let’s get explore!

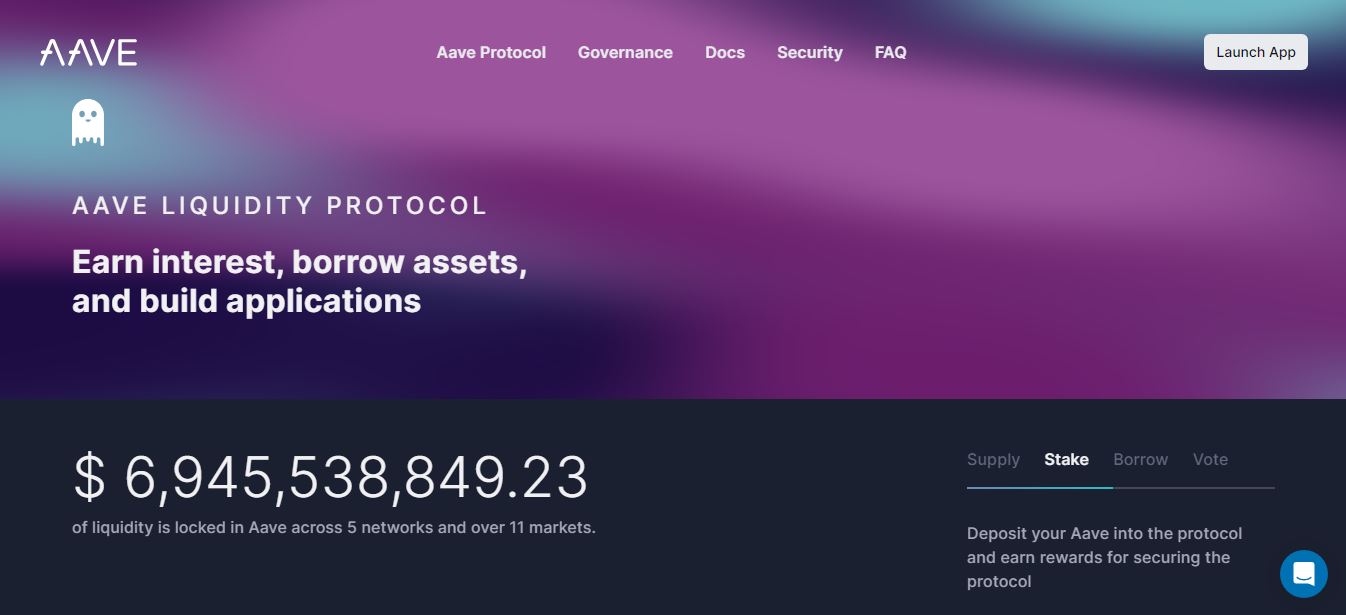

Aave: The Decentralized Finance Powerhouse

A decentralized finance (DeFi) protocol that allows users to lend and borrow cryptocurrencies. With its vast array of supported assets and a user-friendly interface, it’s no wonder why has caught the eye of many investors.

Pros

Diversity: Aave supports a multitude of assets. Want to lend out that unclear token you’ve been holding? Aave’s probably got your back.

User-Friendly Interface: Even if you’re a crypto newbie, navigating Aave is a breeze.

Flash Loans: This feature enables you to borrow assets without collateral for a short period.

Cons

Gas Fees: Be prepared to pay for those snazzy features. Ethereum gas fees can be pretty steep, so tread carefully.

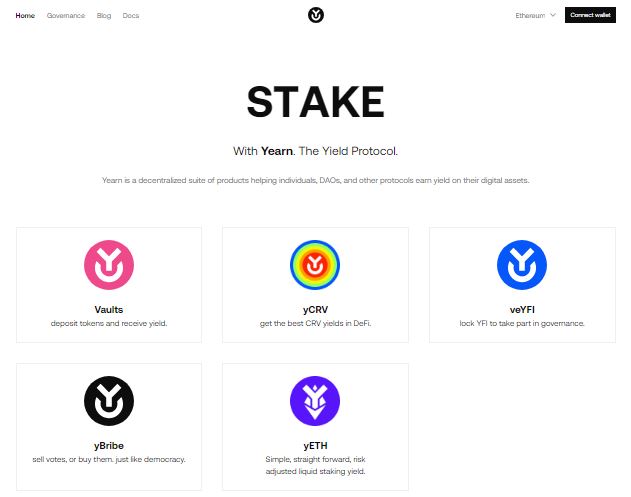

Yearn: The Automated Yield Optimizer

Yearn Finance is basically your own personal farming strategist. It takes your crypto and allocates it to the most profitable strategies, so you don’t have to lift a finger.

Pros

Automated Strategies: No more late nights scouring charts. Yearn does the heavy lifting for you.

High Yields: The platform seeks out the best farming opportunities, making sure you get the most bang for your buck.

Cons

Complexity Risks: Complex smart contracts can be prone to bugs and vulnerabilities. Make sure to read up and be aware of the risks involved.

Curve Wallet: The Stablecoin Maestro

Curve Finance focuses on stablecoins like USDC, DAI, and Tether. It offers low fees and low slippage, making it a favorite among stablecoin enthusiasts.

Pros

Low Fees: Stablecoins are already less volatile, and Curve’s low fees sweeten the deal even more.

Liquidity: With large pools, you’ll have no trouble moving large sums of stablecoins.

Cons

Limited Asset Range: The curve is mainly for stablecoins, which means you won’t find much diversity here.

The Final Verdict: Which Platform Should You Choose?

Well, here we are at the crossroads. Each platform has its own set of pros and cons, and the best one for you depends on your investment goals and risk tolerance.

Making Your Decision:

If you want variety: Aave is your best bet.

For the hands-off investor: You’ll appreciate Yearn.

If stablecoins are your thing: Curve is your go-to.

Conclusion

Yield farming is not just a fad; it’s a legitimate investment strategy that can earn you significant returns on your crypto assets. Whether you opt for Aave, Yearn, or Curve, just remember: always do your own research and never invest more than you can afford to lose. Happy production