- Ethereum Massive Whale Accumulation Continues accumulating massive holdings, with the price not yet showing any reaction. Ethereum whales, also known as addresses holding at least 1 million ETH, have been accumulating ETH at a record pace in recent months. As of October 18, 2023, whale addresses now hold 32.3% of the available supply, which is the highest level since 2016.

🐋 #Ethereum's whale addresses in the #billionaire tier (holding at least 1M $ETH) now hold 32.3% of the available supply for the first time since 2016. Yesterday's transactions valued at $1M+ also had its 2nd highest day in 5 weeks. History is being made. https://t.co/sywdtn14k5 pic.twitter.com/SdbSrChJCf

— Santiment (@santimentfeed) October 17, 2023

This whale accumulation is significant for a number of reasons. First, it suggests that large investors are bullish on Ethereum’s long-term prospects. Second, it could lead to a supply squeeze in the future, which could drive up prices.

Ethereum’s Yesterday’s Transactions Valued at $1M

Whale accumulation is not just the only feat ongoing now on the Ethereum network. Yesterday, October 17, 2023, a record of the second highest day in 5 weeks saw a massive transaction valued at $1M or more. Notably, this suggests that institutional interest in Ethereum is growing. Of course, large investors are moving money into the market in preparation for the next bull run. There’s currently so much happening now to still be in doubt of a bull run happening next year, 2024.

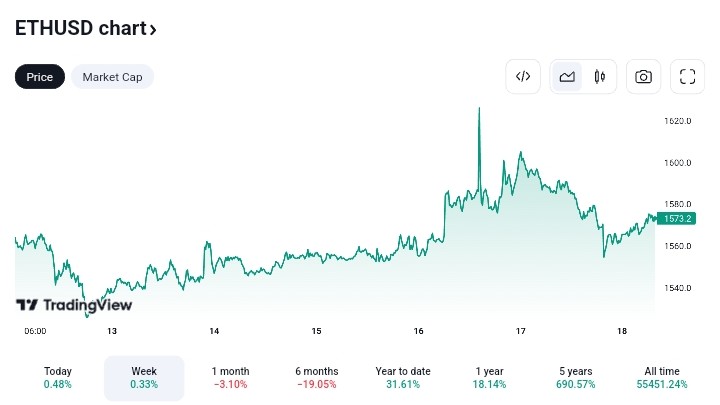

Ethereum Price Technical Analysis

Ethereum’s relative strength index (RSI) is also around the neutral level at 44.5. This suggests that ETH’s RSI is not yet in the overbought zone, so there is still room for ETH to grow.

Overall, the technical outlook for Ethereum is bullish. Whale accumulation and increasing institutional interest are positive signs for the market. Ethereum is trading above its support levels and moving averages, and its RSI is around the neutral level.

What to Watch For In The Next Ethereum Price Movements

If you’re looking out for Ethereum as a good investment then, you must pay attention to these levels. These levels must be monitored especially if you’re a trader with no intention of holding for longer periods. Traders are in the market to make quick gains and exit the market.

Notably, investors should watch for a break below Ethereum’s support levels of $1,544, $1,521, and $1,501. A break below these levels would signal a trend reversal and could lead to lower prices. Ethereum is currently trading at $1,572.

Alternatively, investors should also watch for a break above Ethereum’s resistance levels of $1,638, $1,745, and $1,856. A possible break above these levels would signal an uptrend and could lead to higher prices. This scenario is most likely to occur soon, once Bitcoin maintains its upward trend. Notably, Bitcoin is currently trading at $28,689 at the time of writing. This is after rising from $28,815 to a high of $28,982 in the last 24 hours, after the Bitcoin ETF News Saga.

Conclusion

Of course, Ethereum is on a bullish trend, and the technical outlook is positive at the moment. Whale accumulation and increasing institutional interest are positive signs for the market. Investors should watch for a break below Ethereum’s support levels or a break above its resistance levels in order to make investments decisions.

Additional Thoughts On Ethereum Whale And Price Reaction

Finally, the recent whale accumulation and increasing institutional interest in Ethereum are significant developments. This is not just for Ethereum but also for the general market at large. These trends suggest that large investors are bullish on Ethereum’s long-term prospects.

If whale accumulation continues and institutional interest grows, it could lead to a supply squeeze in the future. Consequently, this could drive up prices, as there will be less ETH available for purchase.

Join Us On Telegram and Coinmarketcap