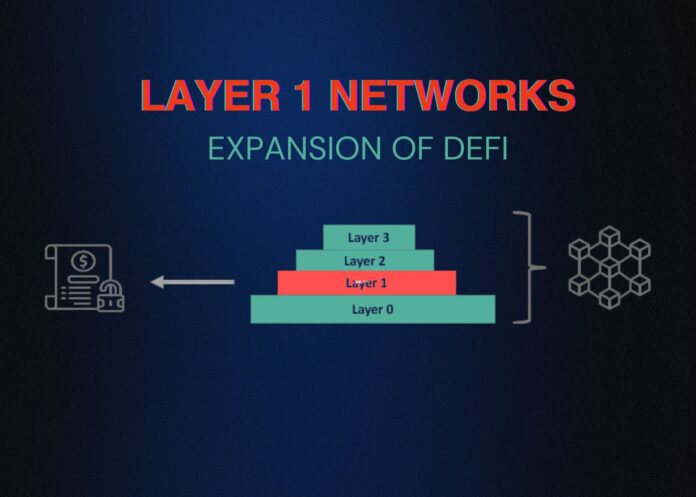

Decentralized Finance (DeFi) continues to evolve and expand its footprint across various blockchain networks. With the growing adoption of blockchain technologies, Layer 1 networks—those that operate as the base architecture of the blockchain—play a pivotal role in this expansion.

This article provides an overview of how DeFi is growing on Layer 1 networks, highlighting the opportunities and challenges this presents.

What is a Layer 1 Network?

A Layer 1 network in blockchain technology refers to the underlying main blockchain architecture. Examples include Bitcoin, Ethereum, Binance Smart Chain, Solana, and many others. These networks provide the fundamental protocol on which all transactions and additional layers (like Layer 2 scaling solutions) are built.

For DeFi, Layer 1 networks are crucial as they offer the infrastructure necessary for running decentralized applications (dApps) that facilitate various financial services without intermediaries.

Growth of DeFi on Layer 1 Networks

The expansion of DeFi on Layer 1 networks is driven by several factors:

Innovation in Financial Services

DeFi platforms on Layer 1 networks offer a range of services, from lending and borrowing platforms to complex financial instruments like synthetic assets and derivatives. These services are designed to be open, inclusive, and interoperable, attracting a broad user base.

Improved Accessibility and Inclusivity

By operating on decentralized networks, DeFi applications lower the barriers to financial services, particularly for those underserved by traditional finance systems. This inclusivity has spurred adoption in regions with high mobile penetration but low banking access.

Network Enhancements and Scalability Solutions

Many Layer 1 networks are continuously upgrading to handle higher transaction volumes and reduce costs, directly benefiting DeFi applications. Innovations such as sharding (as seen in Ethereum 2.0) and new consensus mechanisms are pivotal in these improvements.

Increasing Institutional Interest

As blockchain technology gains legitimacy, more institutions are exploring DeFi. This interest boosts the visibility and viability of DeFi services, promoting further growth.

Challenges Facing DeFi on Layer 1 Networks

While the expansion brings numerous opportunities, it also faces significant challenges:

Scalability Issues

Despite ongoing improvements, many Layer 1 networks still struggle with scalability, leading to high transaction fees and slower processing times during peak usage. This can deter users and limit the potential for DeFi applications.

Security Risks

The decentralized nature of these networks often increases exposure to hacks and security breaches, which have been significant in some cases. Ensuring the security of smart contracts and transaction protocols is crucial.

Regulatory Uncertainty

The lack of clear regulatory frameworks for DeFi can hinder its growth. Both creators and users of DeFi services must navigate a complex and often unclear legal landscape, which can stifle innovation and restrict access to global markets.

Complexity and User Experience

For many potential users, especially those not well-versed in technology, the complexity of using DeFi platforms can be a significant barrier. Simplifying the user experience without compromising security remains a crucial challenge.

Conclusion

Although expansion of DeFi on Layer 1 networks holds great promise, addressing these challenges is essential for its sustainable growth.

By tackling issues related to scalability, security, regulation, and user experience, DeFi can move closer to its goal of revolutionizing the financial landscape.