What is Lido Stake Protocol?

Picture Ethereum as a grand digital kingdom. And like every kingdom, it needs a little help from its citizens to keep it safe and thriving. This is where Lido Finance steps in, making it easy for everyone to join the kingdom’s guardians.When you offer to guard the kingdom with your Ethereum coins (ETH), it’s like signing up for a fun treasure hunt called “staking.” In return for being such an awesome guardian, the kingdom rewards you with more ETH. With Lido Finance, instead of waiting to collect your treasure, they hand you a special coin called stETH. It’s like a voucher that says, “This is how much treasure you’ve got!”

The best part? These stETH coins aren’t just for show. You can use them to trade with other adventurers or even lend them out using the EDGE Browser Extension – Lido DeFi Wallet .

Lido Finance is like that friendly innkeeper in every adventure game. They ensure anyone can join the treasure hunt without the confusing puzzles and riddles. You don’t need to be an expert or have a mountain of ETH coins to start. Plus, they’ve got maps to other realms like Solana, Polygon, and Polkadot too!

So, ready for an Ethereum adventure with Lido?

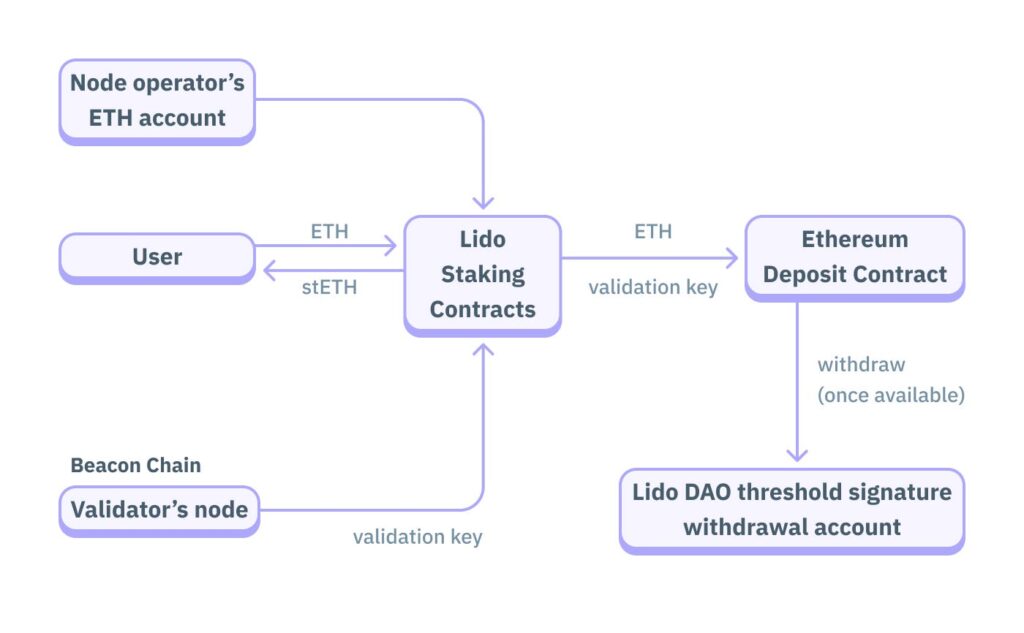

How Does Lido Work?

Imagine having a magical coin pouch. Every coin you place in it multiplies without you doing a thing! Lido works a bit like that, but in the digital world.

Here’s how you can use this digital magic in just three easy steps:

-

Pop Over to Lido’s Magical Shop

Head to Lido.fi and pick the token you’d like to sprinkle with some magic. It’s like choosing a potion ingredient!

-

Watch Your Magic Grow

Once you’ve made your pick, Lido rewards you with shimmering stTokens. The best part? These tokens gather rewards like a magnet attracts metal.

-

Mix and Match for Extra Magic

Think of these stTokens as your magical gems. You can use them in enchanted places like Convex Finance to whip up even more rewards.

Behind the scenes, it’s a hive of wizardry. Lido has a secured vault (like those in fairy tales) where tokens are stored safely. When you deposit, Lido gives you a token (stToken) that’s like a key to your treasure in the vault. And guess what? You can use this key to unlock more treasures in magical lands such as AAVE, Curve Finance, and Convex Finance. All this, while your original treasure stays snug in Lido’s vault.

What kind of stTokens are available with Lido?

Lido currently supports stTokens and staking for the following networks:

-

Ethereum (ETH) – stETH

-

Polygon (MATIC) – stMATIC

You have not selected any currency to display

-

Polkadot (DOT) – stDOT

-

Kusama (KSM) – stKSM

-

Solana (SOL) – stSOL

What To Do With stETH?

Lido’s stETH primarily serves as a liquid staking asset, enabling users to seamlessly earn staking rewards on the Ethereum blockchain. Beyond this primary function, stETH offers diverse potential applications.

However, it’s vital to acknowledge that with these use cases come added risks. Before delving in, users should weigh the potential risks against rewards for each stETH application. Here are some promising stETH use cases:

You have not selected any currency to display-

Hodling

View stETH as a streamlined pathway to stake ETH. Retain it in your wallet and continuously accrue ETH staking returns.

-

Trading

stETH’s liquidity facilitates trades on decentralized and centralized exchanges, as well as swaps through liquidity pools. You can exchange stETH for ETH or other cryptos. -

Liquidity Provision

Pair stETH with ETH or other assets in liquidity pools, fostering stETH-to-ETH exchanges. This also enables Liquidity Providers to reap added rewards.

-

Lending

Platforms like Aave facilitate crypto lending and borrowing. Utilize stETH as loan collateral or lend it out for possible extra earnings.

-

Yield Farming

Augment your stETH returns by depositing on platforms like Yearn or Beefy Finance.

-

Diverse Applications

Numerous applications support stETH, letting users optimize their ETH gains without forgoing staking rewards.

With the DeFi space rapidly evolving, innovative solutions for stETH are emerging. Remember: as solutions become more experimental, risks might escalate.

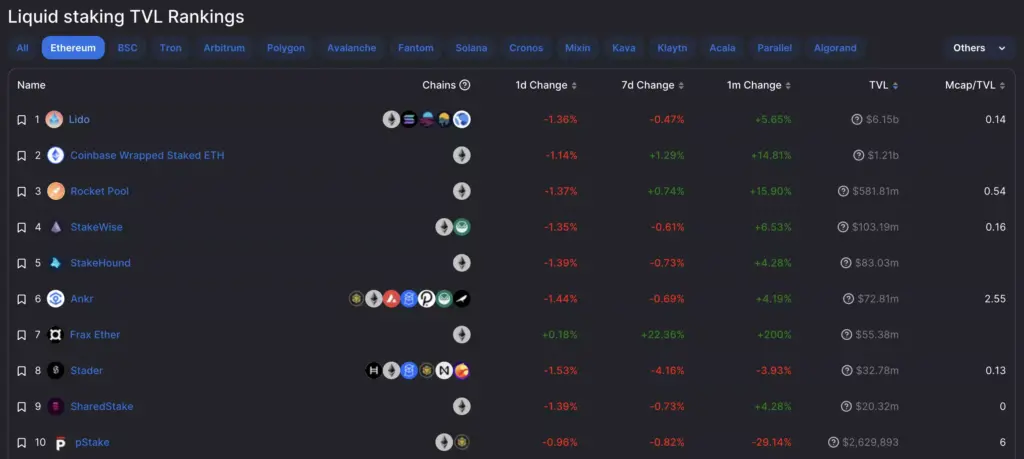

Comparing stETH, rETH, frxETH, and cbETH: Making the Right Choice

Lido’s stETH leads the pack as a favored staking derivative for Ethereum. However, its counterparts – Rocket Pool ETH (rETH), Frax ETH (frxETH), and Coinbase ETH (cbETH) – are not far behind, each offering unique benefits.

Discover the new EDGE Browser Extension for Lido DeFi

- stETH and frxETH cater to those eyeing lucrative yields.

- rETH stands out for enthusiasts prioritizing top-notch security.

- stETH impresses with a harmonious blend of enticing yields, fortified security, and decentralized operations.

If you lean towards the ease of a centralized staking service, Coinbase ETH (cbETH) is a commendable pick. It promises staking rewards nearing 5% APR and a user-friendly interface. However, the centralized nature implies limited control over your assets.

Conclusion

Lido shines as an innovative, trustless, and permissionless staking protocol. It empowers users to seamlessly stake PoS tokens. In return, they receive tokenized versions of these assets, paving the way to harness additional yields from various DeFi platforms.

Key Features of Lido

- Supported Networks: Lido currently extends support for an array of networks. These include giants like Ethereum, Polygon, Polkadot, Kusama, and Solana.

- Stability Measures: While stTokens may occasionally deviate from their peg, especially with high redemption demand, Lido has astutely set up mechanisms. These incentivize market participants to step in and correct any short-lived discrepancies.

Safety with Lido

- Secure Staking: With its reliance on smart contracts, Lido ensures tokens are staked safely.

- Regular Audits: Lido prioritizes user trust by facilitating routine smart contract audits.

- Encrypted Transactions: Every transaction is bolstered with cryptographic security.

Top Picks for Yield and Security

- For Optimal Yields: If high yields are your goal, stETH and frxETH emerge as top contenders among staking derivatives.

- For Unparalleled Security: Those who value security above all should consider rETH.

- Yield Maximization: For stETH holders, Convex Finance stands out as the prime location to amplify their returns.

DISCLAIMER

The information provided here is for informational purposes only and should not be considered financial advice. Engaging in staking, delegation, and cryptocurrency activities inherently involves substantial risks. There’s a potential for significant losses, including the complete loss of all staked digital assets. Furthermore, some protocols may expose delegators to slashing risks due to security or liveness faults. We strongly recommend conducting thorough research and consulting with professionals before selecting a validator.