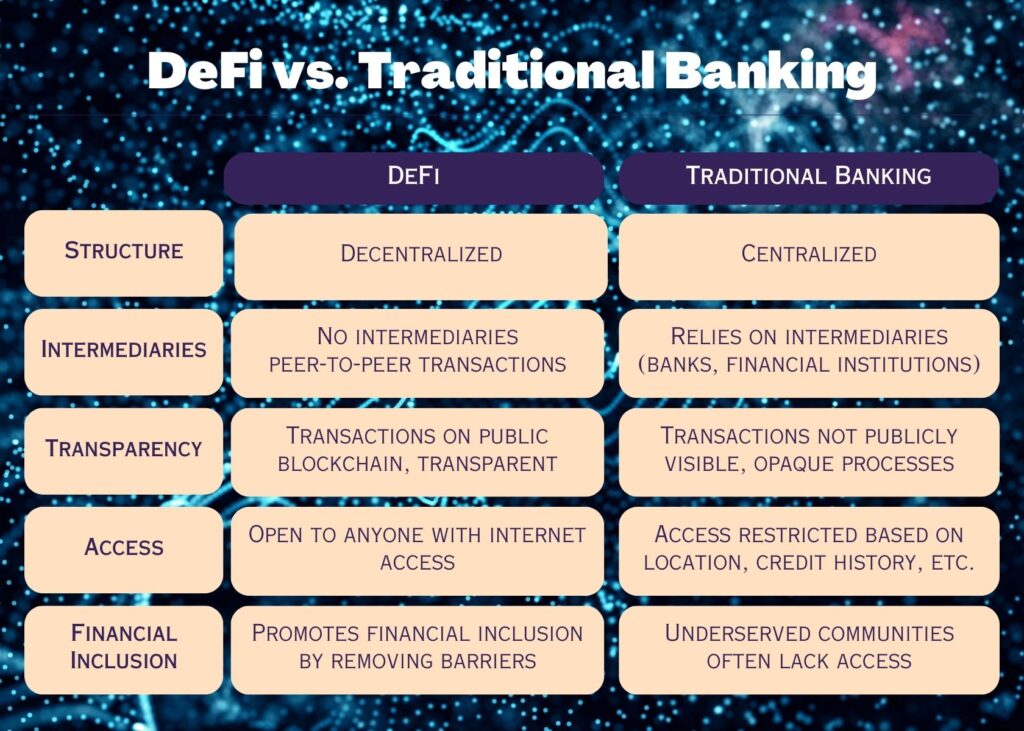

The traditional banking system has been the backbone of financial services for centuries. It provides a centralized infrastructure for managing our money. However, the emergence of decentralized finance (DeFi) has shifted the paradigm. This challenges the status quo and offers a novel approach to financial transactions.

This article aims to explore the impact of DeFi on traditional banking through a comparative analysis, highlighting the key differences and potential implications for the future of finance.

What is DeFi?

Decentralized Finance, or DeFi, refers to a blockchain-based ecosystem that enables financial services and products. Moreover, they do so without centralized intermediaries or middlemen.

It utilizes smart contracts and decentralized applications (dApps) built on blockchain technology that facilitate transactions between users. This helps in eliminating the need for third-party oversight.

Key features of DeFi include:

- Transparency: DeFi protocols operate on public blockchains. Hence, making transactions transparent and publicly verifiable.

- Accessibility: Anyone with an internet connection can access DeFi services, this enhances the financial inclusion.

- Composability: DeFi protocols can be combined and built upon, enabling the creation of complex financial instruments.

Traditional Banking System

A centralized structure characterizes the traditional banking system. Hence, it is where financial institutions act as intermediaries between individuals and the money flow. However, this system relies on trusted third parties, such as banks, to facilitate transactions, maintain records, and ensure compliance with regulations.

However, this centralized model comes with drawbacks:

- Intermediaries and middlemen: The presence of intermediaries increases transaction costs and fees for consumers.

- Lack of transparency: Traditional banking systems often lack transparency, making it difficult for individuals to fully understand the processes and fees involved.

- Limited access: Access to financial services is often restricted based on geographical location, credit history, or other criteria, leading to financial exclusion.

Impact of DeFi on Traditional Banking

The rise of DeFi has the potential to disrupt various aspects of traditional banking. This, in turn, challenges long-standing practices and introduces innovative alternatives.

Disrupting the lending and borrowing market

DeFi protocols like Aave, Compound, and Maker enable decentralized lending and borrowing. Additionally, it is where users can borrow cryptocurrencies without a traditional financial institution.

Moreover, these protocols eliminate the need for credit checks, collateral requirements, and intermediaries. This makes lending and borrowing more accessible and efficient.

Challenging payment systems and remittances

Traditional cross-border payments and remittances are often slow, expensive, and subject to intermediary fees. DeFi protocols like Stellar and Ripple aim to streamline these processes, enabling faster and cheaper international transfers without the need for traditional banking infrastructure.

Democratizing access to financial services

DeFi removes barriers to entry and provides greater financial inclusion, allowing anyone with an internet connection to access a wide range of financial services. This democratization of finance can potentially empower underserved communities and foster economic growth worldwide.

Transparency and trust in transactions

The transparent nature of blockchain technology and DeFi protocols fosters trust in transactions, as all activities are recorded on a public ledger and can be audited by anyone. This level of transparency contrasts with the opaque practices often associated with traditional banking systems.

Conclusion

The impact of DeFi on traditional banking is profound! It challenges traditional practices and brings on a new decentralized and transparent financial services paradigm.

Although DeFi presents exciting opportunities for disruption and innovation, it also faces regulation, security, and scalability challenges.

Ultimately, the future of finance may lie in collaboration between traditional banking and DeFi. This uses the strengths of both systems to create a more accessible, efficient, and inclusive financial landscape.

As the DeFi ecosystem continues to evolve, it will be crucial for regulators, financial institutions, and users to embrace innovation.