The cryptocurrency market is known for its extreme volatility, with prices of digital assets often swinging wildly. Within this market, Non-Fungible Tokens (NFTs) have emerged as a unique and fascinating asset class. Even during bear markets, some NFTs have managed to outperform expectations and deliver impressive returns to their holders. In this article, we will explore the top NFTs that have weathered the storm of a bear market and continued to shine.

- Explanation of NFTs (Non-Fungible Tokens)

Non-fungible tokens (NFTs) have become one of the most captivating and transformative innovations in the world of cryptocurrency and blockchain technology. NFTs represent unique digital assets that cannot be replicated or replaced, making them ideal for representing ownership of digital or physical items, from digital art and collectibles to virtual real estate and even tweets.

- Overview of the Bear Market in Crypto

The crypto market, known for its extreme volatility, experiences periodic phases of bear markets, characterized by falling prices and investor pessimism. These downturns can be challenging for investors, but they also present opportunities for those who can identify assets with resilience and intrinsic value.

- Purpose of the Blog Post

The purpose of this blog post is to explore the performance of NFTs during the bear market, highlighting their unique characteristics and showcasing some top-performing NFTs across various categories. We will also discuss investment strategies for navigating bear markets and consider the future outlook for NFTs.

What Are NFTs?

- Definition and Characteristics

NFTs are cryptographic tokens built on blockchain technology that uniquely represent ownership of digital or physical assets. Their indivisibility, immutability, and scarcity make them ideal for certifying ownership in the digital realm.

- Brief History of NFTs

NFTs gained significant attention in 2017 with the launch of CryptoKitties, a blockchain-based game. Since then, they have evolved and diversified, with artists, musicians, and content creators embracing NFTs as a means to monetize their work and engage with fans.

- Popularity and Growth in the Market

🎉 Celebrating 2 Years of NFTGo 🎉

As we mark our 2nd anniversary, we're thrilled to unveil something monumental for our community—The Genesis NFT Campaign. 🚀【 Stay tuned this month. Each tweet holds a clue to our upcoming special campaigns. 🕵️♂️】

Our vision and mission… pic.twitter.com/G1WkSnDDTz— NFTGo (@nftgoio) September 11, 2023

NFTs have witnessed exponential growth in popularity and adoption. Marketplaces like OpenSea and Rarible have become hubs for NFT trading. Celebrities, artists, and major corporations have joined the NFT frenzy, further propelling their prominence.

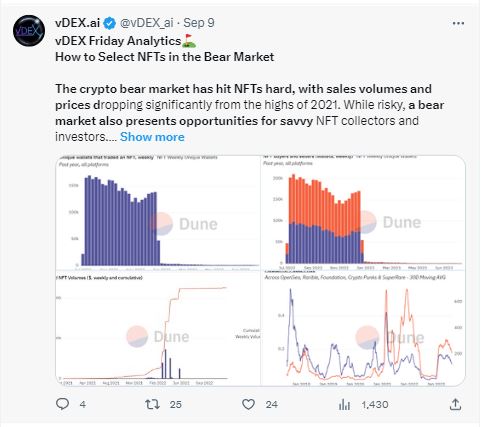

NFTs in the Bear Market

- Understanding Bear Markets in Crypto

Bear markets are characterized by declining prices and a lack of market confidence. Crypto assets, being speculative in nature, are particularly vulnerable during these phases.

- Why NFTs Are Relevant in a Bear Market

NFTs offer a unique value proposition during bear markets. Their scarcity and utility make them attractive as a store of value, especially when compared to more volatile cryptocurrencies.

- Advantages of NFTs in Downtrends

- Hedging against volatility: NFTs can act as a hedge against the broader crypto market, as their value is often less correlated with major cryptocurrencies.

- Tangible utility: Many NFTs provide tangible utility, such as in-game assets, access to exclusive content, or even real-world perks, making them attractive even in bear markets.

Top NFTs That Performed Well

NFT Categories (Art, Gaming, Music, Collectibles, etc.)

NFTs span various categories, including:

- Art NFTs: Digital art pieces often created by renowned artists.

- Gaming NFTs: In-game assets and collectibles with utility in virtual worlds.

- Music NFTs: Exclusive music releases and concert tickets.

- Collectibles NFTs: Rare and limited edition digital collectibles.

Factors Contributing to Performance

Several factors influence the performance of NFTs:

- Celebrity Endorsements: High-profile endorsements can boost the visibility and value of NFTs.

- Utility and Use Cases: NFTs with practical applications tend to hold their value better.

- Scarcity and Rarity: Limited supply and uniqueness contribute to higher demand.

Examples of High-Performing NFTs in the Bear Market

-

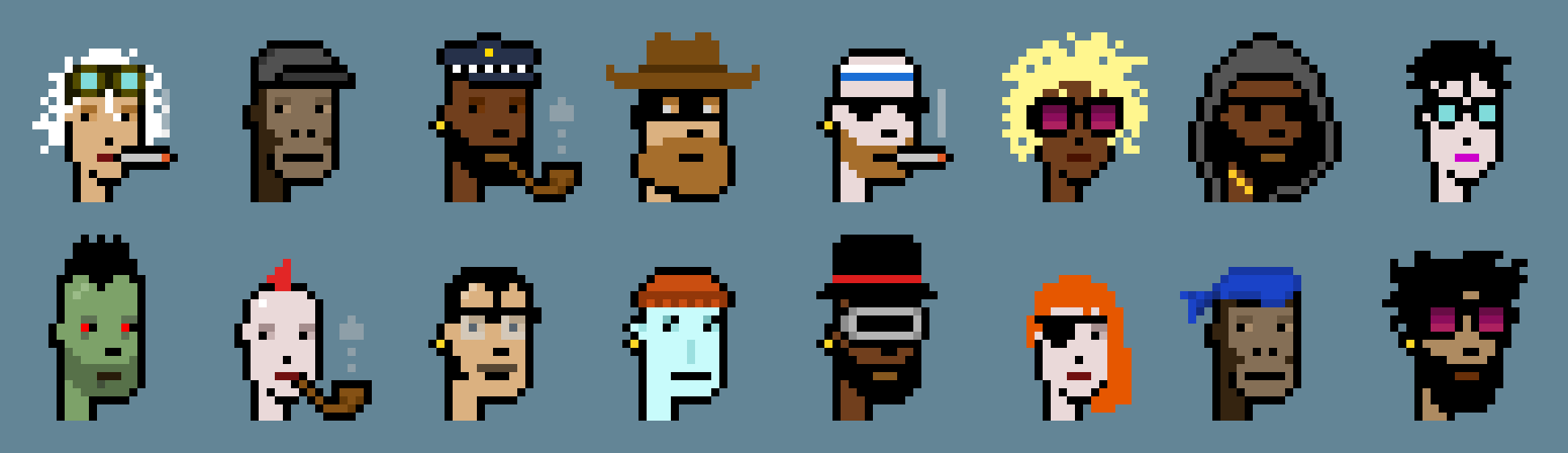

CryptoPunks

To kick things off, let’s talk about CryptoPunks.

CryptoPunks, one of the pioneers in the NFT space, has continued to hold its value even in the bear market. These unique, pixelated characters have garnered immense attention from collectors and investors alike. With their limited supply and historical significance in the NFT world, CryptoPunks have managed to maintain their appeal, making them a valuable asset in the bear market.

Moving on to the next NFT on our list.

-

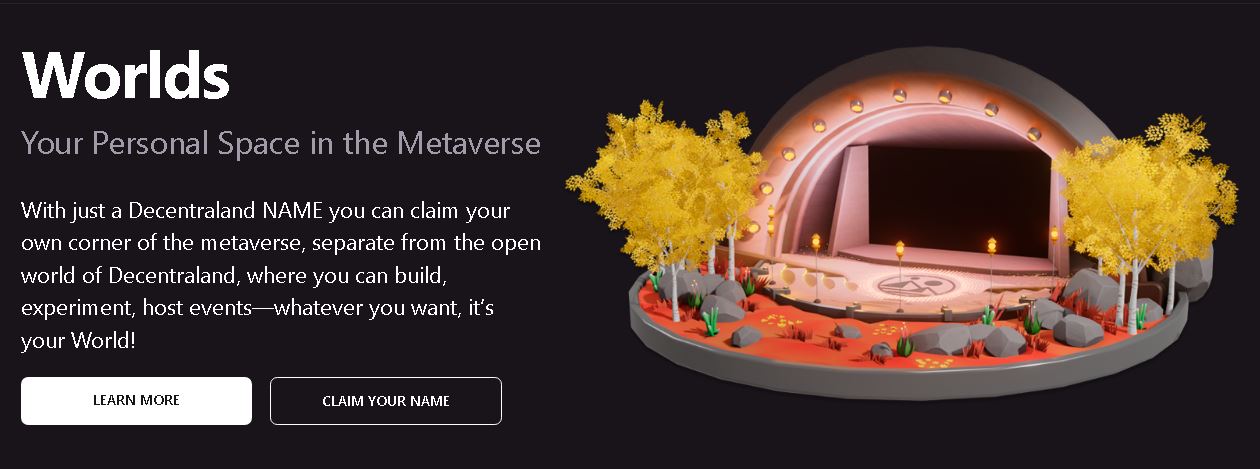

Decentraland

Another standout performer in the bear market is Decentraland.

Situated within the Ethereum blockchain, Decentraland stands as a virtual world where users can acquire, trade, and cultivate their land parcels. Astonishingly, even in the midst of the market downturn, the demand for virtual real estate has exhibited unwavering strength. Decentraland’s pioneering concept, coupled with its vibrant community, has been the driving force behind its continued progress, conclusively demonstrating that NFTs have the capacity to flourish within a bearish environment.

-

Axie Infinity

Axie Infinity has been making headlines in the NFT space.

Indeed, Axie Infinity, a blockchain-based game, enables players to collect, breed, and battle fantasy creatures known as Axies. These creatures take the form of NFTs, and due to their scarcity, their value has surged. Remarkably, even amid a bear market, Axie Infinity has managed to captivate a committed player base and investors alike, underscoring the immense potential inherent in NFT gaming projects.

Let’s move on to the next NFT on our list.

-

Art Blocks:

Art Blocks has been a sensation in the NFT art scene.

Art Blocks, as a platform, empowers artists to craft generative art pieces as NFTs. Intriguingly, these creations are algorithmically generated, guaranteeing the uniqueness of each piece. It’s noteworthy that the amalgamation of artistic value and scarcity has propelled Art Blocks into the spotlight as a standout performer in the NFT realm during the bear market, thus emphasizing the escalating importance of digital art within the crypto landscape.

Data and Statistics on Their Performance

Examining price trends, trading volumes, and adoption metrics can provide valuable insights into the performance of these NFTs during the bear market.

Investment Strategies for Bear Markets

- Diversification

Diversifying your NFT portfolio across different categories can help mitigate risk during bear markets.

- Research and Due Diligence

Thoroughly research NFT projects, their teams, and communities before making investments.

- HODLing vs. Active Trading

Choose an investment strategy that aligns with your risk tolerance and expertise, whether it’s holding long-term or actively trading.

- Risk Management

Set clear risk management strategies, such as stop-loss orders, to protect your investments from significant downturns.

Future Outlook for NFTs

NFTS WILL NEVER DIE!

The NFT ecosystem has grown rapidly this year! Shout out to all the builders & projects still ⛏️ in this bear market!

Check out this comprehensive 2023 NFT landscape map.

👇 Be sure to bookmark before we dive in. 🧵 pic.twitter.com/Lrldlev5Ys

— NFTGo (@nftgoio) September 9, 2023

- Potential for Recovery in Bull Markets

NFTs have shown resilience during bear markets, and as crypto markets recover, they are likely to continue thriving.

- Evolving Trends in the NFT Space

New trends like decentralized autonomous organizations (DAOs), blockchain-based virtual worlds, and metaverse development may reshape the NFT landscape.

- Regulatory Considerations

As NFTs gain more attention, regulatory scrutiny may increase. Staying informed about evolving regulations is crucial for NFT investors.

Conclusion

- Recap of Top-Performing NFTs in the Bear Market

The bear market has seen several NFT categories shine, driven by factors like scarcity, utility, and celebrity endorsements.

- Key Takeaways for Investors

Diversification, research, and risk management are essential for NFT investors in bear markets.

- Encouragement for NFT Enthusiasts in Volatile Markets

Despite the challenges of bear markets, NFTs have proven to be a resilient asset class with the potential for long-term growth. Staying informed and adaptable is key to navigating the ever-evolving NFT landscape.

Follow Us On Telegram